|

|

|

|

|

|

| In the Baltic countries the automotive after sales market consists of 4 850 companies, and most of them are small and medium size with 26 900 employees (Wolk et al, 2010). In the past, the largest part of profit in these companies came from car sales. Currently, the largest profits are generated by automotive after sales (spare parts and servicing). The most popular passenger car brand and, respectively, with the largest aftermarket sales volume in all the three Baltic countries, is Volkswagen. In Latvia there are significantly more vehicles with the engine capacity above 1600 cm2 than in Germany and Italy. In the Baltic countries independent automotive workshops are dominating, but there are no developed workshop service concept chains - in Latvia and Lithuania there is only one for mechanical repairs. From the long-term perspective the competitiveness of small and medium size companies has to be increased in the Baltic countries. Also the competitiveness of the existing small and medium size automotive workshops should be stimulated. It is necessary to create chains of car manufacturers’ authorized companies and independent automotive workshop service concepts, incorporating small and medium size automotive workshops. Besides, new opportunities for independent automotive workshops to compete with car manufacturers’ authorized workshops are provided by European Union Regulation 461/2010. The research has been done by applying the methods of description, analysis, graphic depiction and mathematical statistics. |

|

Key words: after sales services, automotive workshops, service concepts |

The automotive industry and its subordinated markets are considered as one of the most significant industries of the EU, and a driving force of growth, export and innovation. Subordinated markets of the automotive industry are composed of suppliers and service providers (European Economic and Social Affairs Committee, 2009).

For the automotive industry to be successful, technical car maintenance is necessary. Spare parts and services are needed, or, in other words, an automotive after sales market.

Automotive after sales includes:

In the past, in the Baltic countries the largest portion of the profit of automotive after sales companies came from sales of cars and spare parts. Currently, the largest profits are generated by automotive after sales services. In the Baltic countries the automotive after sales market is comprised of 4 850 companies, most of them small and medium size with about 26 900 employees and a total after sales market is almost 800 million Euros (Wolk et al, 2010).

For the successful long term growth of the automotive after sales market it is necessary to increase the competitiveness of small and medium size automotive workshops. They need equipment, information and training of employees. That will help to lower the unemployment and will have a positive affect on development of the Baltic countries.

Most car manufacturers and independent aftermarket research companies had studied automotive the after sales market. However, in the Baltic countries, the opportunities to increase its competitiveness are not sufficient.

The objective of the research is to describe the after sales service market of passenger cars in Latvia, Lithuania and Estonia, and the factors affecting it, and opportunities for increase of its competitiveness.

The following tasks were defined to achieve the objective of the study:

The study information sources have been statistics, special theoretical and methodological literature, and Wolk after sales experts GmbH publications and data basis.

Passenger car park

Automotive after sales market is directly subordinated to the car park being in exploitation, its structure and dynamics. To evaluate the dynamics, the authors checked the number of the registered vehicles in the Baltic countries from 2000-2010 (see Table 1). In the calculations of the Latvian car park the vehicles in technical order (with a passed state technical inspection) have been considered.

In Latvia, until the year of 2009 almost half of the car park had not passed technical inspection and they were not in exploitation. At the end of 2009 and in 2010 there was a massive write off cars in Latvia due to the State tax policy, because from 2010 the government increased the annual fee for passenger cars, determining its payment every year. Regardless the fact that the vehicle is in a technical order (has passed state technical inspection); automatically excluding from the register the vehicles which have not been used for more than 5 years. This measure undertaken by the government significantly reduced the number of the registered vehicles which are not being used, had perished or have been destroyed.

| Table 1. Passenger car park Latvia (units in operation), Lithuania, Estonia, from year 2000 until year 2010 (author’s calculations) | |||||||||

|

Indicators |

Latvia |

Lithuania |

Estonia |

Total Baltic countries |

|||||

|

Numbers of passenger cars |

Chain increase rate, % |

Numbers of passenger cars |

Chain increase rate, % |

Numbers of passenger cars |

Chain increase rate, % |

Numbers of passenger cars |

Chain increase rate, % |

Base increase rate, % |

|

|

2000 |

313 831 |

- |

1 172 394 |

- |

463 900 |

- |

1 950 125 |

- |

- |

|

2001 |

325 145 |

3.6 |

1 133 477 |

-3.3 |

407 300 |

-12.2 |

1 865 922 |

-4.3 |

-4.3 |

|

2002 |

333 134 |

2.5 |

1 180 945 |

4.2 |

400 700 |

-1.6 |

1 914 779 |

2.6 |

-1.8 |

|

2003 |

358 110 |

7.5 |

1 256 853 |

6.4 |

434 000 |

8.3 |

2 048 963 |

7.0 |

5.1 |

|

2004 |

389 929 |

8.9 |

1 315 914 |

4.7 |

471 200 |

8.6 |

2 177 043 |

6.3 |

11.6 |

|

2005 |

423 801 |

8.7 |

1 455 276 |

10.6 |

493 800 |

4.8 |

2 372 877 |

9.0 |

21.7 |

|

2006 |

481 975 |

13.7 |

1 592 238 |

9.4 |

554 012 |

12.2 |

2 628 225 |

10.8 |

34.8 |

|

2007 |

539 017 |

11.8 |

1 587 903 |

-0.3 |

523 766 |

-5.5 |

2 650 686 |

0.9 |

35.9 |

|

2008 |

534 489 |

-0.8 |

1 671 065 |

5.2 |

551 830 |

5.4 |

2 757 384 |

4.0 |

41.4 |

|

2009 |

511 571 |

-4.3 |

1 695 286 |

1.4 |

545 692 |

-1.1 |

2 752 549 |

-0.2 |

41.1 |

|

2010 |

506 870 |

-0.9 |

1 691 855 |

-0.2 |

552 664 |

1.3 |

2 751 389 |

0.0 |

41.1 |

In the Baltic countries, with the economy improving, there was a growth in the number of passenger cars, base increase rate 41.1% (see Table 1). A steady increase of passenger cars in all the Baltic countries took place from the year 2003 to 2007. Considering all the three Baltic countries taken together, it can be seen that an increase of the number of passenger cars continued until 2008 (base increase rate 41.4%). The highest rate of increase of the passenger cars was in Latvia - base increase rate 61.5%, in Lithuania – 44.3%, and in Estonia 19.1%.

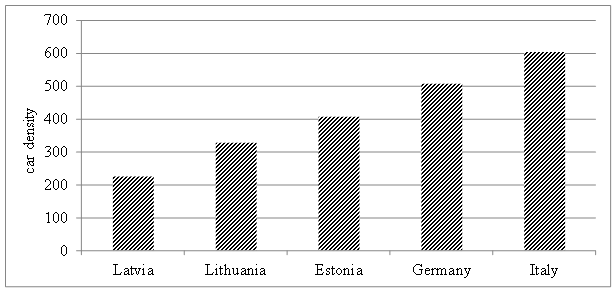

Notwithstanding the rapid growth of the number of vehicles in the Baltic countries, the number of passenger cars per 1 000 inhabitants (car density) is still one of the lowest in Europe (see Figure 1). In Latvia there are 226 passenger cars (in technical order) per 1 000 inhabitants, in Lithuania 329 (in technical order), and in Estonia 407. For comparison, in Germany 508, and in Italy 605.

According to car density in the Baltic countries and, in particular, in Latvia there is still a significant potential for increase of volume of passenger cars, and aftermarket sales market.

|

| Figure 1. Passenger cars per 1000 inhabitants (car density). Source: made by authors in 2010 |

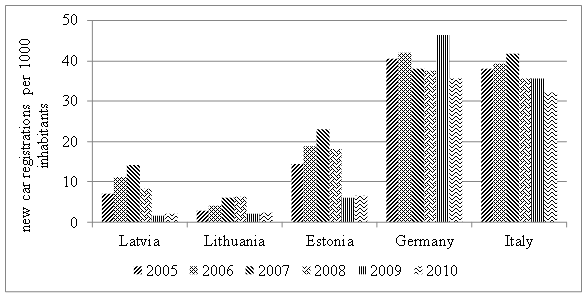

Similar to the car park dynamics, also registration of passenger cars in the Baltic countries increased until 2007 (see Figure 2). In 2007 in the Baltic countries most of the new cars per 1000 inhabitants were registered in Estonia in (23,1), at the same time in Latvia only 14.3 and in Lithuania 6.2 passenger cars. In comparison, in 2007 in Germany 38.3 passenger cars were registered and in Italy 41.8 passenger cars per 1000 inhabitants.

|

| Figure 2. New registrations of new passenger cars per 1000 inhabitants in Latvia, Lithuania, Estonia, Germany and Italy from year 2005 until year 2010. Source: made by authors |

In 2007 in the Baltic countries there were registered 3 times less new passenger cars per 1000 inhabitants. In 2009 in the Baltic countries there were registered already 17 times less new passenger cars than in Germany, namely, 2.7 and 46.5. The increase of the difference in 2009 is explained by the authors as a result of the impact of the economic crises in the Baltic countries and the support program by the German government for the renewal of the passenger car park (when purchasing a new car the bonus was paid for write off of the old car).

The authors conducted the correlation coefficient calculation and established that in the Baltic countries the registration of new passenger cars is essentially affected by inflation (Latvia r=0.760, Lithuania r=0.900, Estonia r=0.739), in Latvia GDP increase rate (r=0.744). A high negative correlation for registration of new vehicles in the Baltic countries was established with an unemployment rate (Latvia r=0.928, Lithuania r=0.825, Estonia r=0.956).

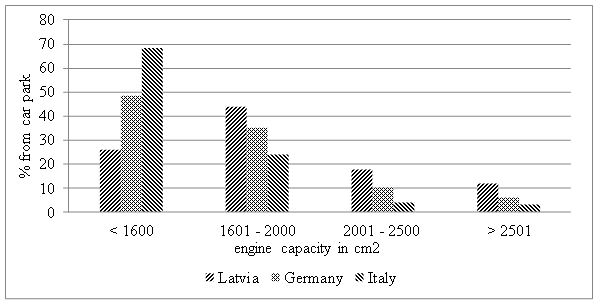

By studying the passenger car structure the authors found out that in Latvia, compared to Germany and Italy, there are significantly less passenger cars with the engine capacity up to 1600 cm2 (see Figure 3). In Latvia 26%, in Germany 48% and in Italy 68% from the number of the passenger cars having an engine capacity up to 1600 cm2.

However, notwithstanding the economic situation of Latvia, it has significantly more vehicles with the engine capacity above 1600 cm2 than in Germany and Italy. In Latvia 74% of the passenger cars are with the engine capacity above 1601 cm2, in Germany 52% and in Italy only 32%. The largest difference is observed in the group with the engine capacity above 2501 cm2; in Latvia 12% of the passenger cars are in this group, while in Germany only 6% and in Italy 3%.

|

| Figure 3. Passenger car park by engine capacity in Latvia, Germany and Italy in year 2009. Source: made by authors |

In the authors’ opinion, the reasons for such a situation are the tax policy differences and also impractical habits of the Latvian drivers. In order to show the tax policy differences, the authors conducted the following calculation: in Germany for a used vehicle with 3000 cm2 with a diesel engine (without a particular filter) the annual payable tax would be approximately 520 Euro (depending from the exhaust gas norms and engine capacity), in Latvia – about 130 Euro (depending from a full mass).

|

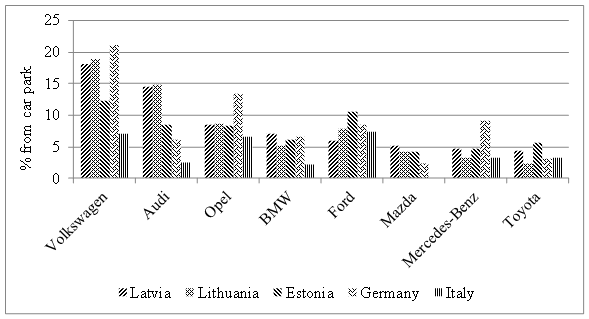

| Figure 4. Passenger car park by brands in year 2010. Source: made by authors |

As shown in Figure 4, the most popular brand having the largest aftermarket sales volume in all the three Baltic countries and in Germany is Volkswagen. In Latvia and Lithuania the second most popular brand is Audi (15% from car park), in Germany 6%. In Estonia the second most popular brand is Ford (11%). Opel is following with 9% in Latvia and Lithuania, and 8% in Estonia. In Germany Opel is the second most popular brand, constituting 13% of the car park. The reason could be practical considerations of purchasers when buying the vehicle.

Car after sales market

About 26 900 are employed in the automotive aftermarket companies of the Baltic countries with the total market value of about 800 million Euro. In the Baltic countries automotive industry aftermarket is made of 4 850 companies and most of them are small and medium size (Wolk et al, 2010).

In Latvia automotive aftermarket services market has developed mainly as subordinated to car or their spare part sales. However, in the recent years with the economic situation changing, car aftermarket sales have become the priority of the corresponding companies.

In the Baltic countries the independent automotive workshops are dominating: in Latvia 93%, and in Lithuania and Estonia 96% of all the automotive workshops are independent. In comparison, in Germany 56% from all the automotive workshops are independent from the car manufacturer (Wolk et al, 2010).

In the authors’ opinion, quite often the largest problem of independent automotive workshops is the quality of the repair, equipment and information shortage which results in the inability to carry out complicated repairs. Likewise, independent workshops could not compete in repair quality with the manufacturer’s authorized workshops, and their repairs are limited by the complexity of vehicles and the need for technologies and expensive diagnostics equipment. However, car manufacturer’s authorized workshops had not used this situation and until now had not practically created car manufacturers’ authorized workshop chains, for example, dealerships of such popular brands as Audi and BMW are only in Riga.

In the Baltic countries, compared to Western Europe, more repairs are needed for running gear, car parts are being repaired instead of replaced. The conditions for the exploitation of vehicles are heavier in the Baltic countries and the vehicles need more repairs. In addition, as already mentioned by the authors, in the Baltic countries compared to Germany and Italy there are significantly more vehicles with the engine capacity above 1601 cm2. These vehicles are usually more complicated and expensive in exploitation, and their repairers need a higher qualification.

In the recent years due to the economic situation, customers’ loyalty has reduced and the repairs carried out by the owners own efforts have increased. Customers choose the cheapest service providers and spare parts, very often forgetting about quality.

Currently, in Latvia, there is an active discussion about the need for certification of independent workshops. However, in the authors view, unfortunately, it will not change the existing situation. For the automotive market to be able to develop, independent service companies need information, equipment and training for employees, which will not be resolved by certification. Certificate will be obtained only by a small number of workshops which already now comply with the requirements.

In the Western Europe, spare part wholesalers provide information, equipment and training for independent automotive workshops, creating service concepts chains. In Europe in 2011 there were 420 various workshop service concept chains for mechanical repairs (Wolk et al, 2011).

There are no developed workshop service concept chains in the Baltic countries - in Latvia and Lithuania there is only one for mechanical repairs (Bosch Car Service). However, in Germany 62% of all workshops for mechanical repairs are part of some service concept chains (Wolk et al, 2011).

In the authors’ opinion, this experience should be taken over also by the large spare part wholesalers in the Baltic countries and they should more actively create workshop service concept chains. Thus, the wholesalers will initiate a higher customer loyalty and will increase the turn-over (usually, workshops have to purchase spare parts from the chain driver).

From the point of view of a long term advancement of the automotive after sales market in the Baltic countries it is essential to increase the competitiveness of the existing small and medium size automotive workshops. Manufacturers ‘authorized companies’ chains and independent automotive workshop concept chains should be created, incorporating into them small and medium automotive workshops.

Besides, new additional opportunities for independent automotive workshops to compete with car manufacturers’ authorized workshops are provided by European Union Regulation 461/2010, which also determines a new definition for new, original spare parts.

In accordance with the EU Regulation 461/2010 original spare parts are:

Also under the legal warranty (2 years), a consumer has the right to choose the maintenance or regular repairer freely, without losing the warranty.

Under various additional guaranties - if a customer purchased a warranty extension. It might be committing to go only to a vehicle manufacturer’s authorized workshop, then, in order not to lose this guaranty, the repair and maintenance shall be done only in a vehicle manufacturer’s authorized workshop;

Central Statistics Bureau., [online]. [ Seen on: 12.09.2010.]. http://www.csb.gov.lv.

European automobile manufacturer’s’ association. [online].[ Seen on: 12.09.2010.]. http://www.acea.be.

Markets subordinated to car industry and manufacturing of car parts: European Economic and Social Affairs Committee, Conclusion of June 4, 2009., [online].[ Seen on: 07.11.2009.]. http://eurlex.europa.eu/ LexUriServ /LexUriServ.do?uri=OJ:C:2009:317:0029:0036:LV:PDF.

Statistics Estonia., [online].[ Seen on: 15.09.2010.]. http://www.stat.ee.

Statistics Lithuania., [online].[ Seen on: 15.09.2010.]. http://www.stat.gov.lt.

Wolk H., Nikolic Z., Aboltins K., et al (2011). Garage service concepts in the European car aftermarket. Bergisch Gladbach: Wolk after sales experts GmbH, 632 pages.

Wolk H., Nikolic Z., Aboltins K (2010). The car aftermarket in Estonia. Bergisch Gladbach: Wolk after sales experts GmbH, 67 pages.

Wolk H., Nikolic Z., Aboltins K. (2010). The car aftermarket in Latvia. Bergisch Gladbach: Wolk after sales experts GmbH, 76 pages.

Wolk H., Nikolic Z., Aboltins K. (2010). The car aftermarket in Lithuania. Bergisch Gladbach: Wolk after sales experts GmbH, 73 lpp

|

Saturs. Table of Contents |

Ģirts Brasliņš, Aleksis Orlovs OPTIMAL CAPITAL STRUCTURE FOR SUCCESSFUL COMMERCIALIZATION OF INNOVATIONS |

|