Dennis Jarvis, Ph.D.

La Jolla, Calif., U.S.A.

Ardyth B. Sohn, Ph.D.

Henderson, Nev., U.S.A.

|

The authors explore how a product in the health communications field is recast into a vibrant cross-cultural brand that is launched through a combination of digital and traditional media. Theoretical, as well as professional implications for the future of branding are explored via this research question: What is the effectiveness of breakthrough advertising when it is introduced in a campaign that utilizes multiple media platforms? The analysis indicates how both market data and creative decision making affect and drive media planning. The authors utilize a real life case study of how a medical device manufacturer systematically deployed a Direct-To-Consumer strategy with a blend of traditional, digital and social media along the following path: (1) global positioning testing of key messages and audience appeal; (2) creative strategy designed to “break the mold” and appeal to a new audience of consumers; (3) media plan, utilizing consumer demographics and psychographics to maximize reach and frequency with prime audiences; (4) Simulated Test Marketing to derive volume potential and marketing plan optimization; (5) validation (live) test markets, with media monitoring metrics and consumer awareness tracking. The paper illustrates how well crafted advertising messaging that captures emotional and functional elements, and deploys an integrated media plan targeted to key audiences can be effective in building awareness and demand in categories that heretofore had been off limits for consumer pull strategies. Keywords: media, media campaigns, blended media, advertising. |

This case study focuses on the launching of an innovative product by a company that seamlessly integrates digital and traditional media for a successful communications campaign. The research drills into the details that drive decisions concerning building a brand and finding and motivating a market in a specialized prescription medical device sector. While the case study approach does not allow generalizations, it does provide useful in-depth analysis of realistic challenges and opportunities facing current marketing professionals and suggests theoretical directions for future research. The research references both qualitative and quantitative data, which were collected and utilized for the company’s global marketing plan.

Advertising and marketing have always involved targeted media campaigns, but in the last decade technological innovations have opened the field to more digital options. Although 85 percent of advertising (Young 2010) is still invested in traditional media, successful campaigns today must engage audiences via a blended approach that strategically weds traditional media with newly emerging media. While traditional media can “push” campaigns to valued known consumers, new technologies allow consumers to search and select content from the environment. Open-system theory (Katz and Kahn, 1978) provides context for consideration of multiple communication vehicles for new products like the one discussed in this case study. Differentiating the product not only from competitors but also for current or potential customers requires: 1) strategic consideration of all available media options for branding the product appropriately; and 2) opening environmental opportunities to discover and grow consumers (Sylvie et al. 2008). The theory suggests that consumers can be both passive and active, but when they actively survey the media environment they are most often seeking decisions related to entertainment, social needs or ways to better understand themselves (Lacy and Simon 1993).

The importance of accurately assessing the readiness of consumers for education, details or additional information is critical because consumers can be very selective about their interactions with advertising content. Sweden’s Research International reports that 22 percent of consumers actively avoid advertising in all media while a global media survey by Synovate found that 67 percent of respondents think TV has too many ads and some 40 percent think the Internet has too many ads. This same study also showed 80 percent of Internet users in Australia, Canada, Spain and the U.S. avoid websites with “intrusive” advertising (Young, 2010, p. 12). Responses from the industry have reflected these findings with nimble companies using the innovations in digital media to adjust marketing campaigns to real time.

Branding can be traced back to an 1875 Bass Ale trademarked brand in England (Moffitt and Dover, 2011) and it remains core to marketing in the digital age, perhaps even more so than 138 years ago. The proliferation of branded messages has mushroomed geometrically as we moved into the digital age. According to Jay Walker–Smith of the Yankelovich Marketing firm in an interview with CBS News, the average number of advertising messages a consumer is exposed to daily has increased from an estimated 500 in the 1970’s to 5,000 today (Johnson, 2009). While this estimate may be debatable, there is no denying that the explosion in commercial messages an average consumer may come across each day is significant. With this level of clutter, it is more important than ever for marketers to develop and nurture their brands, so that they are readily accessible, viscerally as well as consciously, by their target audiences. The rules have changed, as the Internet has turned upside-down how consumers interface with their brands. Today, consumers systematically use digital media to process brands and will engage in social media forums about their brand experiences even after purchase. Sound marketing strategies need to incorporate this very active consumer dynamic to decision making (Edelman, 2010). As a result, consumer brand marketers build digital and social media into their communication plans. The importance of including digital media in an overall ad campaign for medical devices is further underscored by the report that in 2008 over 145 million U.S. consumers used online sources for general health and medical information (FDA, 2012). With the continuing growth of mobile devices and the proliferation of specific apps for all lifestyles we can only expect this dynamic to become stronger.

Campaigns typically include targeting niche groups with specific messages via preferred traditional and digital media. One approach to discussing branding strategies is to determine if a message is designed to “push or pull” the consumer to the product. The push promotion is designed to build and ensure awareness of the brand and takes the product to the customer. The pull strategy is aimed at motivating the customer to actively seek out the brand and create a demand for it (Push, 2012). In building both push and pull campaigns, marketing is aimed at increasing emotional appeal and eventually behavioral action. However, the transition from awareness to action is not easily accomplished through traditional media alone and reinforcement with digital media can be effective. The aim today is to integrate media components to build evolving relationships that connect consumers to brands in a way that fosters and encourages multi-level communication.

While research and data help to define relevant consumers for a brand, an average consumer or even an average American does not exist. Simplistic groupings based on broad demographics have been replaced by micro trends that represent groupings of consumers likely to initiate behavioral action (to accept or purchase a brand) based on appropriate contexts, media experiences, marketing efforts, cultural factors or insights they share (Young, 2010). Some of these factors can be revealed in consumer surveys or audits but many times experts or suppliers of the brand working with the consumers can as accurately predict behavior. They listen to consumers and observe factors that influence consumer decision-making. Analysis of conversations on social media sites also can predict consumer intentions to take action related to a brand.

The following case study is based on a real world example to provide context and illustrate the strategic process one specialized medical device company undertook to deploy a unique communications campaign through an integrated blend of new and traditional media with the objectives of building consumer brand awareness and interest and driving trial. The “Company,” its product, trademarks, agencies, data and the specific medical field in which it competes are masked to protect confidentiality and all things proprietary.

The Situation

The Company holds exclusive patents on a medical device technology in its respective sector. Highly acclaimed physicians and scientists developed the non-invasive technology at an internationally renowned university medical center. The product’s introduction to the medical profession was based on a carefully crafted global distribution plan, focusing on physicians who were key opinion leaders in the field, as well as those identified as exceptional practitioners who would quickly seize on the opportunity to incorporate the new technology into their clinics. As with other manufacturers in this medical space, the Company generally relied on a push strategy to reach consumers – i.e., prescribing physicians would present the new treatment to their existing patient base. Because of the innovativeness of the technology, the Company benefited from frequent press coverage and features on popular television programs, in major magazines and newspapers, as well as online. Additionally, the topical nature of the technology and the benefits it provided represented a leverage point to build social engagement and led to a sizable following through a combination of organic as well as paid efforts in social media. The Company leadership recognized that there remained a significant opportunity to build a major global brand footprint and implemented a pull strategy to aggressively drive demand with a Direct-To-Consumer (DTC) approach similar to what many pharmaceutical manufacturers employ (In 1997, the U.S. Food & Drug Administration issued guidelines that allowed manufacturers to use television advertising for the education and promotion of prescription drug brands. Direct-To-Consumer advertising by the pharmaceutical industry has increased by 330 percent since the guidelines were issued [Donohue et. al. 2007], and it now spends over $5 billion annually in the U.S. on DTC. All medical device manufacturers combined – ophthalmic, orthopedic, cardiology and cosmetic surgery, as examples –spend less than 4 percent of that amount, even with regulatory allowance.).

Positioning Development

Based on industry statistics, only about five percent of the population in developed countries has undergone some type of physician directed treatment with a related medical device or service to that of the Company – a segment referred to as “experienced.” In qualitative focus groups conducted prior to finalizing the positioning for the new product, the Company learned that consumers who had never tried a related product or service held reservations centered around concern for invasive (or surgical) techniques, lack of convenience – i.e., time in the practitioner’s office – and downtime affecting life’s normal activities following the procedure. In order for these “non-experienced” consumers to consider the product, or procedure, proof would be required that these concerns could be assuaged. Additionally, this very large consumer segment required the following reassurances: veracity of the science at the foundation of the device; evidence of efficacy relevant to their individual needs; safety by way of verifiable clinical results; and clear communication of country specific regulatory clearance, such as from the U.S. Food & Drug Administration (FDA). The Company’s medical device met each of the requirements of the non-experienced segment. Accordingly, the Company tested a preliminary positioning concept with messaging that addressed its clinically proven efficacy for a wide range of patient physiological types, device safety, its being non-surgical (Non-surgical was selected as the preferred label over non-invasive as it was more easily understood by non-experienced consumers.), with no lost time from daily work or lifestyle activities and regulatory clearance.

Quantitative concept tests were conducted in the U.S., Asia and Europe. The results discussed here focus on key insights from the U.S. portion of the research, which was conducted among a representative sample of 1,000 consumers. The Company learned that its positioning concept would appeal to over 40 percent of the population, which is substantial in light of the fact that only five percent of the population had ever tried a similar medical device. A CHAID (Chi-Square Automatic Detector) analysis was then applied to the group for whom the concept was appealing, to identify underlying demographic and behavioral patterns that could assist with subsequent audience targeting. Key patterns were determined around gender, physiological characteristics and their interaction. Because emotional appeal plays such an essential role in effective brand positioning, the Company used Factor Analysis to analyze a battery of lifestyle statements followed by Multiple Regression to first simplify the lifestyle range, and second to determine which factors were most predictive of concept appeal. Two emotionally laden factors were significant in predicting appeal, accounting for more than half of the variance. The first was the positive feeling about oneself with the procedure, and conversely, the second was the sense of inferiority without the benefits from the procedure. This preliminary positioning concept development and its testing were key in the preparation of the creative brief and strategy that would be used to drive advertising development.

Strategic Roadmap to Global Rollout

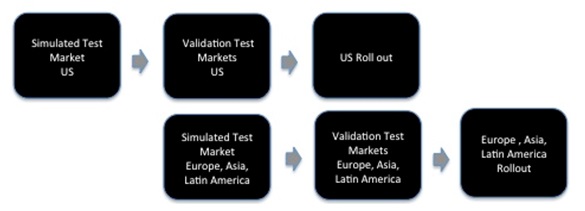

The innovativeness of the Company’s intended approach to attract both experienced and non-experienced consumers carried a level of uncertainty on how to optimize the strategic approach and led to a staging path (Figure 1) to ensure both an effective and an efficient expenditure in the marketplace. The Company focused on major global markets where there was regulatory clearance for Direct-to-Consumer advertising.

|

| Figure 1. Stages of Ad Campaign Testing and Roll Out |

The case study now turns to the preparation leading to the campaign and the first two stages in the U.S. The second stage, Validation Test Markets U.S., was partially completed at the time of this writing.

Ad Agency Selection

The competitive landscape in which the Company’s medical device participates is cluttered with sameness relative to promotional messaging, with the experienced consumer segment targeted almost exclusively. Competitive promotional messages rely on functional before and after treatment images that do little to incorporate lifestyle and emotional appeal. The Company held to a self-imposed mandate that its campaign must be different. It sought an advertising shop that was cutting edge, with nothing clearly in common with other agencies assigned to competitive products in the respective device sector. In fact, the Company firmly believed it needed an agency with no pre-conceived dispositions whatsoever about the category. After an agency review, the Company selected a creative boutique based on the West Coast of the U.S. The executive creative director and principal of the selected Ad Agency held a worldwide reputation for delivering breakthrough consumer campaigns, often in low interest and commodity categories, which are deemed challenging due to the paucity of product differentiation, and with demonstrable results. As the Company CEO noted, “We must break the rules if we hope to attract this new audience of non-experienced consumers. Our Ad Agency selection moves us in that direction.”

Advertising Development

Advertising creative, media (traditional, digital and social) and public relations strategies were developed in parallel and in a collaborative fashion, owing to the importance of their integration. The creative brief was developed by the Ad Agency and the Company’s marketing organization. The target audiences outlined in the brief leveraged the learning from the positioning testing, which identified a gender balance with a slight weighting of the casting towards females, and an age profile of 30 to 54. The creative brief set in motion a campaign that worked hard to distance the brand from all others in the given medical device sector in which it competed. The Ad Agency and Client agreed that the campaign needed to embrace an attitude – aligned with the earlier learning of lifestyle predictors for consumer impact – that communicated extreme confidence, “mojo,” and a swagger enabled from the results of the Company’s brand. Furthermore, the Ad Agency strongly encouraged an irreverent tone in the creative that would provide an increased likelihood of the campaign breaking out of the pack; the Company enthusiastically endorsed this approach.

The creative brief also emphasized that, in addition to building brand awareness, there was a level of complexity in the full product story that could not be succinctly communicated in a single ad, but was essential for consumer education and subsequent trial. This would require the work of multiple media formats, operating with a gestalt like affect. The ad campaign would build awareness and the desire to learn more; the provocative call to action pointed the consumer to the Company’s website for a comprehensive presentation of the science behind the treatment, its functional and emotional benefits, and information for locating a practitioner who used the device in their clinic. Accordingly, the creative brief outlined the approach for developing a full range of ad campaign assets that would complement one another as they were deployed in various media – TV, print, out-of-home (static, mobile and electronic billboards and public transit venues), digital, and social media assets – to reach the target audiences. Last, but not least, the Company’s website would be refreshed to incorporate the campaign’s look and feel. Still, the question remained: “How well will the advertising communicate the message, and will the media and PR plans with it produce the desired results?”

Media Plan

The initial step in the media process was the selection of a planning and buying agency. It was essential that the Media Agency have global capabilities. The Company teamed with its Ad Agency (i.e., the Agency charged with delivering the creative) and decided to partner with one of the leading independent media agencies in the US, which was also part of a larger international network and could prepare media strategies in all developed countries.

The first charge given to the Media Agency was the development of an overall media strategy and plan that could be translated for use in the Simulated Test Marketing (STM) noted in Figure 1, and with the subsequent insights from the STM iterate into plans for the Validation Test Markets. The approach for the STM was based on simple reach and three-plus (3+) frequency thresholds among the target audiences for the three month campaign launch and sustainment thereafter (The three-plus frequency guideline is commonly used by media planners and is based on the principle that an advertising message needs to be seen or heard a minimum of three times to have impact.). In addition to the target audience implications derived from the preliminary concept testing, the Agency also employed the Simmons and A.C. Nielsen media databases to further pinpoint the most opportunistic segments and their media consumption patterns – digital, social and traditional – using a combination of demographic and psychographic statistics. Noted below is a breakdown of the profile characteristics of the two primary target audiences developed by the Media Agency.

| Table 1 |

| Non-Experienced Segment | Experienced Segment |

|

|

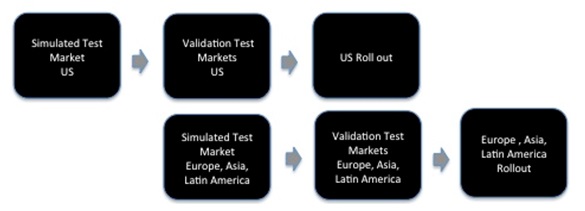

Based on the ad campaign creative, the target audience profiles, reach and frequency goals, and planned spending levels the Media agency developed a blended new and traditional strategy (Figure 2) designed to have synergistic impact.

|

|

Figure 2. Media Mix and Weighting* *Weights shown are approximate and reflected as percentage of total media expenditure |

The digital and traditional media mix elements were selected with a specific purpose for each that complemented the others, and as specified in the creative brief, directed the consumer to the Company website where they would experience a comprehensive explanation of the technology and its benefits.

Public Relations Strategy

A strong public relations strategy plays a key role in most marketing plans. Marketers generally believe that well placed media from PR can be as much, if not more powerful than an ad in generating interest. With regard to the current situation, the Company believed it had what amounted to a perfect storm: a highly topical medical device plus a unique and provocative ad campaign. This combination represented significant strength to capitalize on the inherent publicity opportunities that would emerge and put the cap on an integrated communications tapestry of digital, social, traditional and PR media. The Company enlisted its PR Agency to develop a full-scale strategy that would embrace not only standard fare, but also grass roots and guerrilla marketing tactics that would be prime for the consumer target audiences and lead to pick-up by local media outlets. Additionally, the PR Agency was charged with development of strategic outreach for the medical professional. The PR plan also had to be scalable from live (Validation stage) test marketing to the future rollout.

Simulated Test Marketing

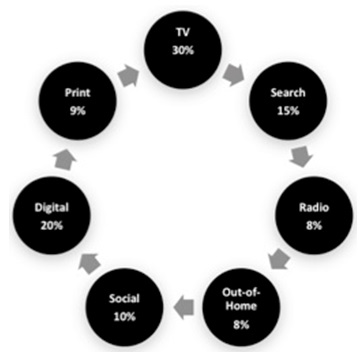

Simulated Test Marketing, or pre-test marketing, first appeared in the industry in 1968, with the Laboratory Test Market introduced by Yankelovich, Skelly and White (Clancy and Shulman 1991) in response to marketing organizations’ needs to reduce the risk with new product or campaign introductions. The Simulated Test Market (STM) provides manufacturers a mechanism to affordably evaluate the potential of a new product idea or campaign to achieve business objectives prior to launching in a live market. Given the preponderance of product and campaign failures – an estimated 80% to 90% of products fail or underachieve within three years following introduction (Copernicus Marketing Consulting and Research 2010) – companies seek as much early intelligence as possible to better position themselves for success. An STM incorporates survey research input on consumer preferences, behaviors and attitudes, as well as market conditions, and specific marketing and communications plans. These inputs are then subjected to a series of proprietary algorithms and econometric modeling to derive a forecast – annual and month-to-month – and sensitivities with respect to which variables most impact the forecast. These sensitivities may isolate target audience definitions, media weight and mix, pricing, availability (distribution), etc. that can be then used to modify the plans prior to live market implementation. A general overview of STM inputs and outputs is summarized in Figure 3.

STM methodologies have much evolved since the first model and now include MARC’s Assessor (Originated at the Massachusetts Institute of Technology), Copernicus’ Discovery, A.C. Nielsen’s BASES (with the largest STM market share), IPSOS’ Vantis, and TNS FYI, among others. At first, STMs were most applicable to consumer packaged goods but are now also readily used in service, technology, durable goods, pharmaceutical, medical device and health care industries, and implemented in most developed countries. STMs have proven very robust in addressing any and all elements of the marketing mix, including new media and new distribution channels. An STM can be completed in less than ten weeks, at an expense of about €74,750 ($100,000), with full secrecy, which is a major consideration in highly competitive sectors. A live market test will typically run a minimum of 12 months and at a cost of multiple millions with no real secrecy. Given these factors, as well as the general accuracy of STMs, +/- 10% at 90% confidence, it is little wonder that companies are utilizing STMs with such frequency as early warning and optimization methodologies. Upon completion of an STM, manufacturers will pursue any of several possible options: (1) immediate full-scale launch in the market, perhaps with marketing plan refinement based on the STM sensitivity analyses; (2) validate the STM in a live market test; (3) revise the market positioning and plan and run another STM; (4) change the product design; (5) go with some hybrid of the preceding alternatives; or (6) retreat altogether.

The Company submitted a request for proposal to three STM providers. Following careful evaluation of the proposals, the Company elected to utilize the system that provided additional diagnostics with regard to the STM provider’s media database and technique for evaluating the advertising campaign, along with its global capabilities.

|

| Figure 3. Overview of Simulated Test Market Inputs and Outputs |

The STM was run on a U.S. national plan, as well as individually for each of the specific Validation Test Markets noted in the second stage of the ad campaign roadmap illustrated in Figure 1. The online STM survey was conducted among a sample of 1,800 consumers. Each sample respondent was exposed to an ad campaign proxy, followed by the information they would see on the Company website (the call to action when seeing the ad), and a representation of the interaction with the medical practitioner and their staff regarding the treatment. Following these exposures, respondents were queried regarding their interest in seeking more information on the medical device treatment, their likelihood of actually purchasing the treatment (a significant volume driver), its uniqueness (key in determining differentiation in the marketplace), believability, relevance, price-value, desired versus actual accessibility of practice locations (i.e., travel distance and required travel time), rating of the ad prototype via the STM provider’s proprietary ad processing method and other diagnostic measures. Data were collected individually from statistically representative samples in each of the Validation Test Markets, as well as for the total U.S. (for the future rollout), and included volumetric (unit and revenue) forecasts at low, base and high media spending levels individually for each geography.

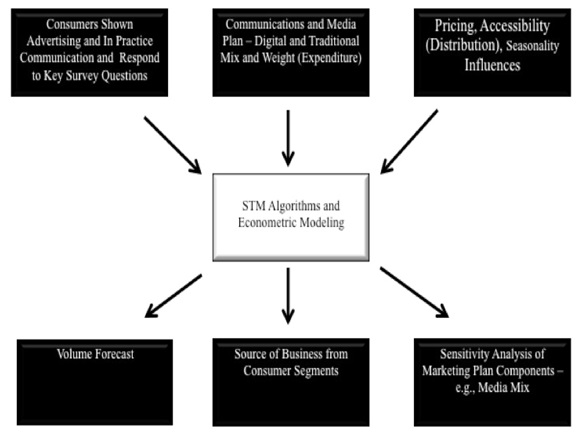

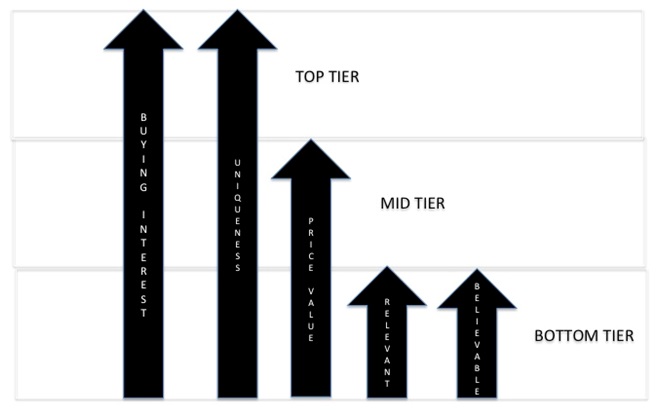

As illustrated in Figure 4, data from the primary consumer measures incorporated in the econometric modeling, produced both good news for the Company’s campaign, as well as news on areas that could be strengthened prior to launch in live Validation Test Markets. Buying intention and uniqueness were both in the top tier of the STM provider’s normative database (Normative levels were derived from the provider’s database that includes STMs on over 1,000 premium priced products in health care, pharmaceuticals and medical devices). These two measures are core volume forecast drivers, and the strong rating on uniqueness for the Company’s brand – i.e., perceived as definitively different from other products – suggested the potential for marketplace “buzz,” including an advantage in social media engagement. Price-value was rated as just about average on the normative scale, with believability and relevance in the lower tier (Relevance was affected by one-third of the sample thinking the physician would rule them as not eligible for the treatment.). The insight from the ratings of the latter two measures, in conjunction with the ad evaluation (noted below), proved especially useful to the Company and the Ad Agency in the final crafting of the ad campaign before production (Of note, it is not unusual for marketing researchers to observe an inverse relationship between the uniqueness assessment and the believability rating for a concept or ad – i.e., very unique ideas may be seen as more difficult to believe).

|

|

Figure 4. Primary Measures for Company’s Brand Compared to Normative Tiers of STM Provider |

The proprietary ad assessment methodology of the STM provider was applied to the Company’s ad campaign prototype. With an impact score just under 60 percent, the campaign was deemed by the STM provider to be a clutter buster, and possessing strong potential to build awareness. The ad assessment technique suggested that the campaign could be strengthened by inclusion of clearer messaging regarding the non-surgical aspects of the treatment, along with its safety, and regulatory clearance. Additionally, the data suggested an upside to modifying the selection of the female and male models in the campaign so that the target audiences would more easily relate to them. Insights from these findings, along with what was observed with respect to the primary measures of believability and relevance, were applied to the ad.

The next step was the revenue forecast produced by the quantitative modeling. The modeling utilized algorithms from the STM provider’s database of simulations in related categories, which have been calibrated to actual in-market experiences. The primary measures from the consumer survey, the media plan, social media, public relations, pricing, practitioner accessibility, market conditions, seasonality influences, Census data, and other secondary inputs were assessed. Multiple model scenarios were run based on different media spending levels. The mix by media type was proportioned based on the structure shown in Figure 2. Two spending level forecast scenarios are noted here. The base media spend plan forecast indicated that the campaign would produce a revenue increase over 60 percent versus business as usual, and as much as over 200 percent with higher spending. Additionally, the sensitivity analysis provided by the STM illustrated that volume could be increased up to 30 percent by improving relevance and believability as noted above. Further increases were also indicated by the sensitivity analysis with modifications in other non-campaign areas – e.g., proximity of treatment locations. In sum, the STM highlighted the potential for a very favorable ROI (Return on Investment) from the campaign. Following the completion of the STM in the U.S., the Company readied implementation in its global markets –i.e., those markets where regulatory agencies permit Direct-To-Consumer advertising – the first being in Europe.

Validation Test Markets (U.S.)

The objective of the second stage to the campaign rollout was to validate the STM in a live market setting in the U.S. Three representative cities were selected, one each in the Eastern, Central and Western U.S. The final advertising production drew from the results of the STM and affected all media assets – TV, out-of-home, digital, social, print, radio and search. The media spending in these markets was scaled based on the national level. The media plan employed a “flighting” schedule, with television and out-of-home front loaded to accelerate the awareness build in the first weeks of the launch, as well as social to capitalize on the topicality of the campaign and the engagement benefits of this medium. Radio and print were placed immediately following the first flight of television to personalize (radio with disc jockey endorsements) and sustain the message. Digital and search media were run continuously on a 24/7 schedule. As with the advertising creative, the media plan was modified based on the learning from the STM. The PR Agency identified major local market events – music, art and food festivals, as examples – that afforded ideal sponsorships and enabled the Company to implement such activities as flash mobs to draw attention to the ad campaign and brand. The Company monitored campaign performance on a regular basis across multiple metrics including: brand awareness through consumer survey tracking, web traffic, digital media performance, media mix efficiencies, social monitoring, physician feedback and unit growth. The complete Validation Test Market stage was designed to run for 12 months, with the first four months completed at the time of this writing.

The launch produced significant growth in campaign awareness (over 90 percent rate of increase versus the pre-campaign tracking, or “ghost awareness” measurement), yielding an approximate 25 percent increase in specific brand registration. Digital ad performance was especially noteworthy, with the overall the Click-Through-Rate (CTR) four times greater than the industry norm, and was particularly strong on health sites, Twitter and social gaming networks. Consistent with emerging overall patterns in the digital industry, CTRs were highest for mobile devices (phones and tablets). As discussed earlier, the campaign’s call to action pointed the consumer to the Company website for more information and education about the product, and where they would find a medical practice locator for the treatment. Google Analytics reported the average weekly visits up over forty-five times compared to pre-campaign levels, and the use of the site’s medical practice locator up thirty times. Follow-up surveys with physicians indicated a significant increase in prospective patient inquiries for the product and the scheduling of appointments for treatment consultation at the practice. The average unit and revenue growth across the three test cities for the first four months of the campaign significantly outperformed the demographically matched control cities established for the test. At the end of the four-month period, the campaign was on track to deliver the ROI level identified in the STM.

Today’s consumer is more active than ever, using social media after their purchase as well as during the decision making process (Edelman 2010). This dynamic requires marketers to incorporate these ever evolving formats in their business strategies. Accordingly, the case presented demonstrates how blending of traditional with new media enables campaigns to add multiple levels of effective interaction with consumers and further ensure delivery of the promised brand experience, which is very much related to the engagement opportunities provided.

The importance of digital media in an overall communication plan for health and medical product marketers is underscored by the strong inclination of consumers to use digital media to answer their health care and medical information questions – 145 million information seekers in the U.S. in 2008. Medical and health care marketers, all marketers for that matter, will also need to continue to capitalize on the marketplace explosion of mobile devices (smart phones, tablets and the next innovations) and lifestyle apps for these devices. As reported by Pelletier (2012) for the Association of American Medical Colleges (AAMC), there are about 40,000 health-related mobile apps now available. Pelletier also cites data from Juniper Research of Great Britain, which estimated there were 44 million health-related apps downloaded in 2012 and projects it to reach 142 million annual downloads in 2016. The case study presented by the authors illustrates the strength of the mobile segment of digital media, with the highest CTRs observed for phones and tablets. The recent announcement of the Facebook Phone presents yet another evolutionary step in the blending of digital technology. Additionally, the case study demonstrates that, as with any marketing element, digital media sites (programs, bloggers, for example) can and should be targeted to the demographics and lifestyles of prime target audiences to be most effective.

The case also demonstrates how Simulated Test Marketing methodologies have become increasingly important to campaign assessment because they allow analysis of a mix of marketing options and are robust to the inclusion of digital and social media, which are evolving on a rapid-fire basis. STMs enable marketers to optimize all elements of the media plan for maximum effectiveness and efficiency prior to actually going live, which is significant given the very high cost of consumer advertising in general.

As suggested by Open-System theory, the case demonstrates how media environments can respond to the concerns and needs of consumers.

Clancy, K. J. and Shulman R. (1991). The Marketing Revolution. New York: Harper Collins Publishers, Inc.

Copernicus Marketing Consulting and Research (2010). Top 10 Reasons For New Product Failure. AMA Green Book Online.

Donohue, J.M., Cevasco, M. and Rosenthal, M.B. (2007). A Decade of Direct-to-Consumer Advertising of Prescription Drugs. New England Journal of Medicine, 357 (7), 673–681, as referenced on en.wikipedia.org.

Edelman, D.C. (2010). Branding in the Digital Age. You’re Spending Your Money in All the Wrong Places. Spotlight on Social Media and the New Rules of Branding. Harvard Business Review. Harvard School of Business.

FDA (2012). Advertising Guidances. Retrieved from en.wikipedia.org and www.fda.gov/drugs/GuidanceComplianceRegulatoryInformation/guidances/ucm064956.htm.

Johnson, C.A. (2009). Cutting Through Advertising Clutter. Retrieved from www.CBSnews.com.

Katz, D. and Kahn R. L. (1978). The Social Psychology of Organizations. New York: Wiley.

Lacy, S. and Simon, T. (1993). The Economics and Regulation of United States Newspapers. Norwood, NJ: Ablex.

Moffitt, S. and Dover, D. (2011). Wikibrands: Reinventing Your Company in a Customer-Driven Marketplace. New York, NY: McGraw Hill.

Pelletier, Stephen G. (2012). Explosive Growth in Health Care Apps Raises Oversight Question. AAMC Reporter. Retrieved from Association of American Medical Colleges, www.aamc.org.

Push and Pull Marketing Strategies (2012). Retrieved from www.marketing-made-simple.com/

Sylvie, G. et al (2008). Media Management: A Casebook Approach (4th edition). New York: Routledge, Taylor and Francis Group.

Young, A. (2010). Brand Media Strategy: Integrated Communications Planning in the Digital Era. New York, N.Y.: Palgrave Macmillan, St. Martin’s Press.